Financial Planning Essentials for Entrepreneurs

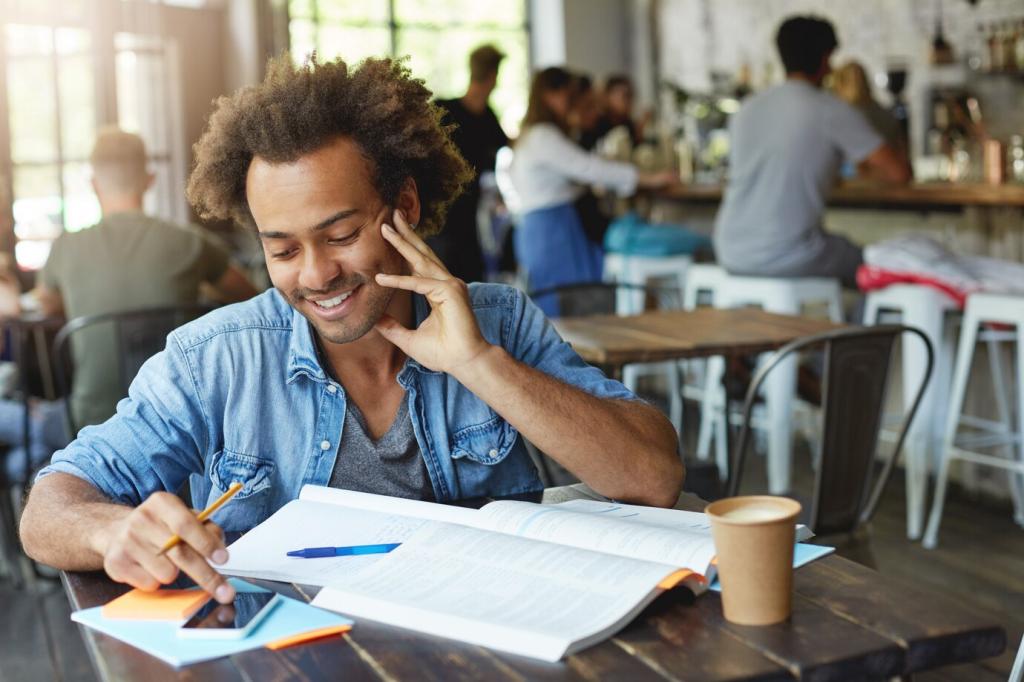

Chosen theme: Financial Planning Essentials for Entrepreneurs. Build a resilient company with practical money habits, clear forecasts, and calm, confident decisions. This is your friendly, straight-talking guide to turning scrappy hustle into sustainable, long-term financial strength.

Create a weekly cash flow sheet that lists expected receipts and payments. A founder I coach discovered a seasonal dip by doing this and negotiated supplier terms, turning a scary shortfall into a smooth month. Try it, then share your biggest insight.

Cash Flow Mastery: Keep the Lights On and the Momentum High

Zero-Based Budgeting for Clarity

Start each period from zero and justify every line. One SaaS team cut 22% of unused subscriptions by asking, “Does this cost create measurable value now?” Try a quick audit today and comment with the sneakiest expense you found.

Differentiate Fixed, Variable, and Optional Costs

Classify costs to know what can flex when sales dip or surge. Founders who separate “must-haves” from “nice-to-haves” recover faster during slow months. Download our checklist, then share which optional cost you plan to pause first if needed.

Tie Budget to Growth Milestones

Release spending when targets are met, not before. For example, unlock ad scale after achieving a proven CAC and payback period. What milestone will gate your next investment? Post it below to keep yourself accountable and help others learn.

Smart Funding: Choosing the Right Money at the Right Time

Bootstrap, Debt, or Equity?

Bootstrap to stay scrappy and focused, use revenue-based or bank debt for predictable paybacks, and consider equity when the opportunity is huge and time-sensitive. Which path matches your cash flow reality today? Share your reasoning and get founder feedback.

Understand Dilution Before You Sign

Model future rounds, option pools, and liquidation preferences. A founder once realized a “friendly” term sheet would leave them with less than 20% at exit. If you want our cap table model, subscribe and reply with your stage and team size.

Communicate Metrics, Not Hype

Investors and lenders trust consistent updates: revenue, gross margin, churn, and burn multiple. A reliable monthly note can open doors when you need them most. What three metrics will you report every month? Add them in the comments to commit.

Taxes and Compliance Without the Panic

LLC, S-Corp, or C-Corp impacts taxes and fundraising. Use separate accounts, a disciplined chart of accounts, and monthly reconciliations. A little structure now saves painful cleanups later. What bookkeeping rhythm works for you? Share your cadence below.

Forecasts, KPIs, and Decisions You Can Explain

For SaaS, track MRR growth, churn, CAC, LTV, and gross margin. For e-commerce, watch AOV, conversion rate, inventory turns, and return rate. Which three metrics truly drive your margin? List them below and tell us why they matter.

Forecasts, KPIs, and Decisions You Can Explain

Forecast from assumptions—traffic, conversion, pricing, and retention—so updates are quick and honest. A founder using this approach spotted a conversion bottleneck and doubled trials with one landing page fix. Want the template? Subscribe and we’ll share it.